Commonly, there are ways to invest in unit trust:-

A) LUMP-SUM

The minimum lump sum investment in a unit trust is normally RM 1,000. There is no limit on how much you can save and invest in a unit trust. This way method only emphasizing investor to invest for the initial date and can be top-up whenever they want to (not regular basis). Investment using EPF (1st account) also consider as lump-sum method but depend how regular investor investing their fund. Each investor eligible to invest using their EPF for every 3 months EPF as long there is sufficient amount of funds available and follows standards conditions.

Even though,if you are making a very large investment, it is usually advisable to spread your holdings among different funds. Diversify your funds. If you are worried that the stock market could fall back from a peak just as you invest your lump sum, you could consider investing it gradually through a regular savings plan

B) REGULAR SAVING PLAN

This is most popular way chosen by the investors. Regular savings plan allows investors to put in a set amount monthly to the unit trust of their choice. Usually the minimum initial amount is RM 1,000.00 . The investor able to top-up the fund on monthly basis. The minimum monthly additional investments usually start from RM 100.00; there are 2 ways for this top-up which can be done either manually or auto-deduct from bank account (SI).

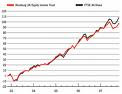

The regular savings plan is also flexible since they are not tied to a particular period of time. This can enhance the returns from unit trust that performs reasonably well over a long period. An advantage of the regular savings plan is that they even out fluctuations in unit price. The same investment each month will buy more units when the price is lower and fewer when the prices are high. The effect of ringgit cost averaging, as it is called, is to make the overall cost of units slightly cheaper. Of course, another advantage is that you can cash in the whole lot or part of it without penalty on any business day. Regular savings plan can improve returns significantly in the long run.

No comments:

Post a Comment